Market Overview

The Nikkei 225 is a stock market index that measures the performance of the top 225 companies listed on the Tokyo Stock Exchange (TSE). It is a widely recognized benchmark for the Japanese equity market and a barometer of the overall health of the Japanese economy.

Amidst the hustle and bustle of the financial world, the Nikkei 225 index, like a knight in shining armor, stood tall as a beacon of stability. Its steady rise evoked images of a knight of the seven kingdoms show , valiantly defending its realm against adversity.

Yet, like the ebb and flow of the tides, the Nikkei 225’s strength was a testament to the ever-changing landscape of the global economy.

The index was first launched in 1950 and has since become one of the most important stock indices in the world. It is calculated by taking the weighted average of the share prices of the 225 companies included in the index. The weights are based on the market capitalization of each company, with larger companies having a greater influence on the index.

The Nikkei 225, a bastion of stability in the tumultuous financial world, has been roiled by rumors of a mad king’s reign over its hallowed halls. The mad king , with his erratic decrees and capricious whims, has cast a shadow over the market, sending investors scurrying for cover.

Yet, amidst the chaos, the Nikkei 225 remains a beacon of hope, its resilience a testament to the enduring strength of the Japanese economy.

Major Sectors

The Nikkei 225 is heavily weighted towards the industrial and financial sectors. The top three sectors in the index are:

- Manufacturing (35%)

- Financials (25%)

- Consumer discretionary (15%)

Some of the largest companies in the Nikkei 225 include Toyota Motor Corporation, Sony Corporation, and Mitsubishi UFJ Financial Group.

The Nikkei 225, Japan’s benchmark stock index, has been on a rollercoaster ride lately. Some analysts believe that the index is due for a correction, while others believe that it has further to climb. One analyst who is bullish on the Nikkei 225 is Fabrizio Laurenti.

Laurenti believes that the index is undervalued and that it has the potential to reach new highs in the coming months. He cites the strong performance of the Japanese economy and the low interest rate environment as reasons for his optimism.

Whether or not Laurenti’s prediction comes true remains to be seen, but the Nikkei 225 is certainly one to watch in the coming months.

Factors Influencing Performance

The performance of the Nikkei 225 is influenced by a number of factors, including:

- Economic growth: The index tends to perform well when the Japanese economy is growing.

- Interest rates: Higher interest rates can make it more expensive for companies to borrow money, which can hurt their earnings and stock prices.

- Foreign exchange rates: The value of the Japanese yen relative to other currencies can impact the profitability of Japanese companies that do business overseas.

- Political stability: Political uncertainty can hurt the confidence of investors and lead to a decline in stock prices.

Performance Analysis: Nikkei 225

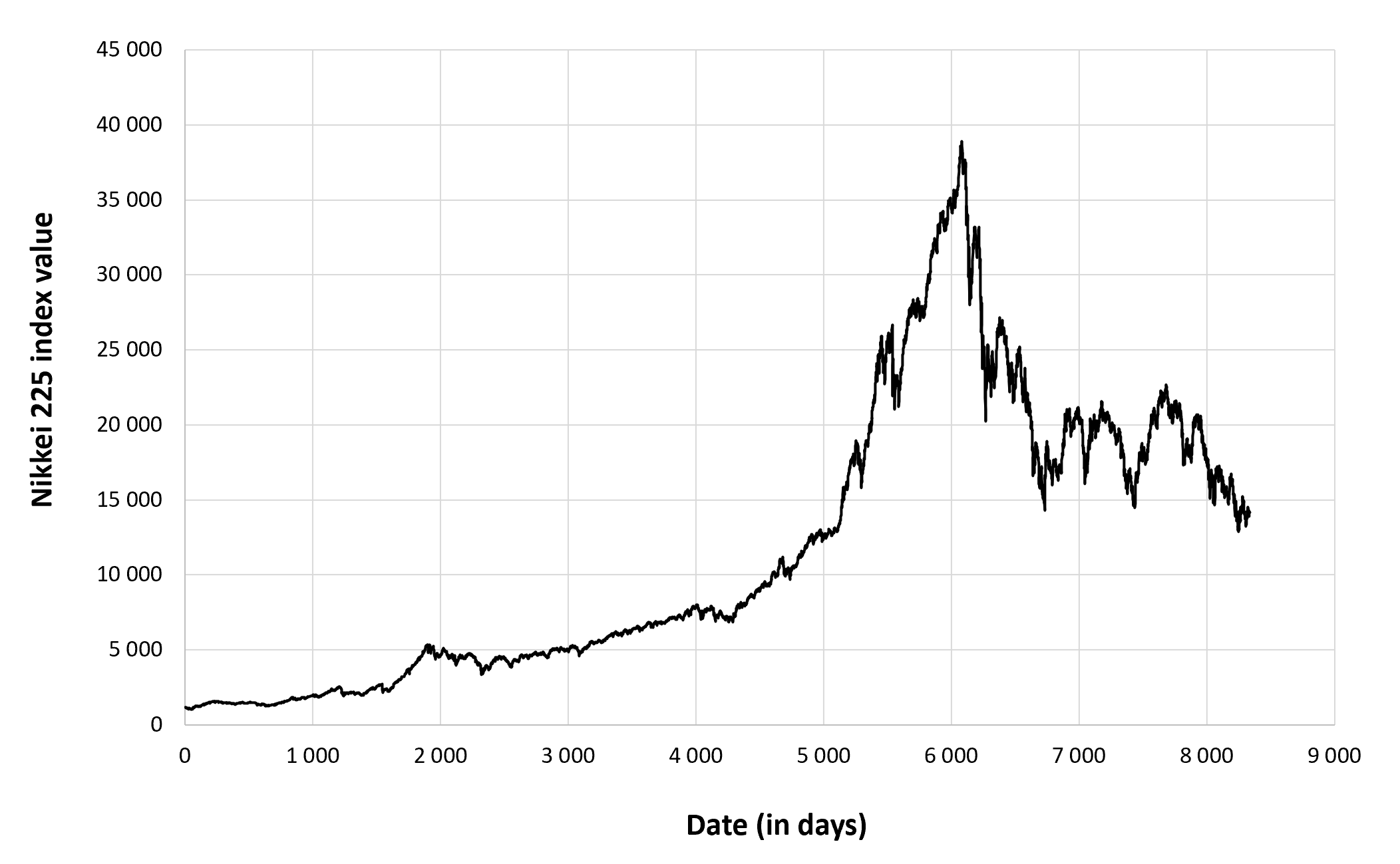

The Nikkei 225 has a long and eventful history, reflecting the economic ups and downs of Japan. Over the past several decades, the index has exhibited periods of both strong growth and sharp declines.

Key events that have impacted the Nikkei 225’s performance include the 1980s asset price bubble, the 1990s economic recession, and the 2008 global financial crisis. In recent years, the index has been influenced by factors such as the Bank of Japan’s quantitative easing program and the COVID-19 pandemic.

Long-Term Trends, Nikkei 225

Over the long term, the Nikkei 225 has shown a positive trend, albeit with significant volatility. The index reached its peak in December 1989 at over 38,000 points, before crashing in the early 1990s. It then entered a period of prolonged stagnation, known as the “lost decade,” before recovering in the early 2000s.

Volatility

The Nikkei 225 is known for its volatility, which is influenced by a number of factors, including economic news, political events, and natural disasters. The index has experienced several sharp declines in recent years, including a 20% drop in 2018 and a 30% drop in 2020.

Correlation with Other Markets

The Nikkei 225 has a positive correlation with other major global stock indices, such as the S&P 500 and the FTSE 100. However, the correlation is not always strong, and the Nikkei 225 can sometimes move independently of other markets.

Outlook

The outlook for the Nikkei 225 is mixed. In the short term, the index is likely to be influenced by the global economic recovery and the ongoing COVID-19 pandemic. In the medium term, the index is expected to benefit from the Bank of Japan’s continued monetary easing program. However, in the long term, the index could face challenges from Japan’s aging population and declining birth rate.

Investment Strategies

The Nikkei 225 presents various investment opportunities, each carrying its own set of risks and rewards. Here’s a breakdown of some popular strategies:

Index Tracking

Index tracking involves investing in a fund or exchange-traded fund (ETF) that replicates the Nikkei 225. This strategy offers broad market exposure, reducing individual stock risk while providing the potential for steady returns that align with the index’s performance. However, it limits the potential for outsized gains compared to active management strategies.

Sector Rotation

Sector rotation involves shifting investments among different sectors within the Nikkei 225 based on economic trends and market conditions. This strategy aims to capitalize on sector-specific growth opportunities and mitigate risks by diversifying across industries. However, it requires active monitoring and timely adjustments to capture market shifts.

Stock Picking

Stock picking involves selecting individual stocks within the Nikkei 225 based on fundamental analysis, technical analysis, or a combination of both. This strategy offers the potential for higher returns but also carries higher risks as it relies on the performance of specific companies. It requires thorough research and a deep understanding of the market.

Nikkei 225, Japan’s primary stock index, has recently experienced a surge in activity, mirroring the fervor surrounding the iconic game of thrones banners. The banners, adorned with the sigils of noble houses, have become a symbol of the epic struggle for power.

Similarly, Nikkei 225 reflects the aspirations and uncertainties of investors, mirroring the tumultuous battles and shifting alliances that define the financial world.

The Nikkei 225, a stock market index that tracks the performance of the top 225 companies in Japan, has been on a steady upward trajectory in recent months. While the release date of the highly anticipated “A Knight of the Seven Kingdoms” TV show remains uncertain, speculation suggests it may arrive sooner than expected.

The Nikkei 225’s positive performance reflects the growing optimism surrounding Japan’s economic recovery.